I am posting the list of stocks that you can keep in your watchlist for this month and possibly trade as well if they fit your setup. I prefer only those stocks that are fundamentally good, because there is a possibility to hold these stocks for the long term. Enjoy reading the list below.

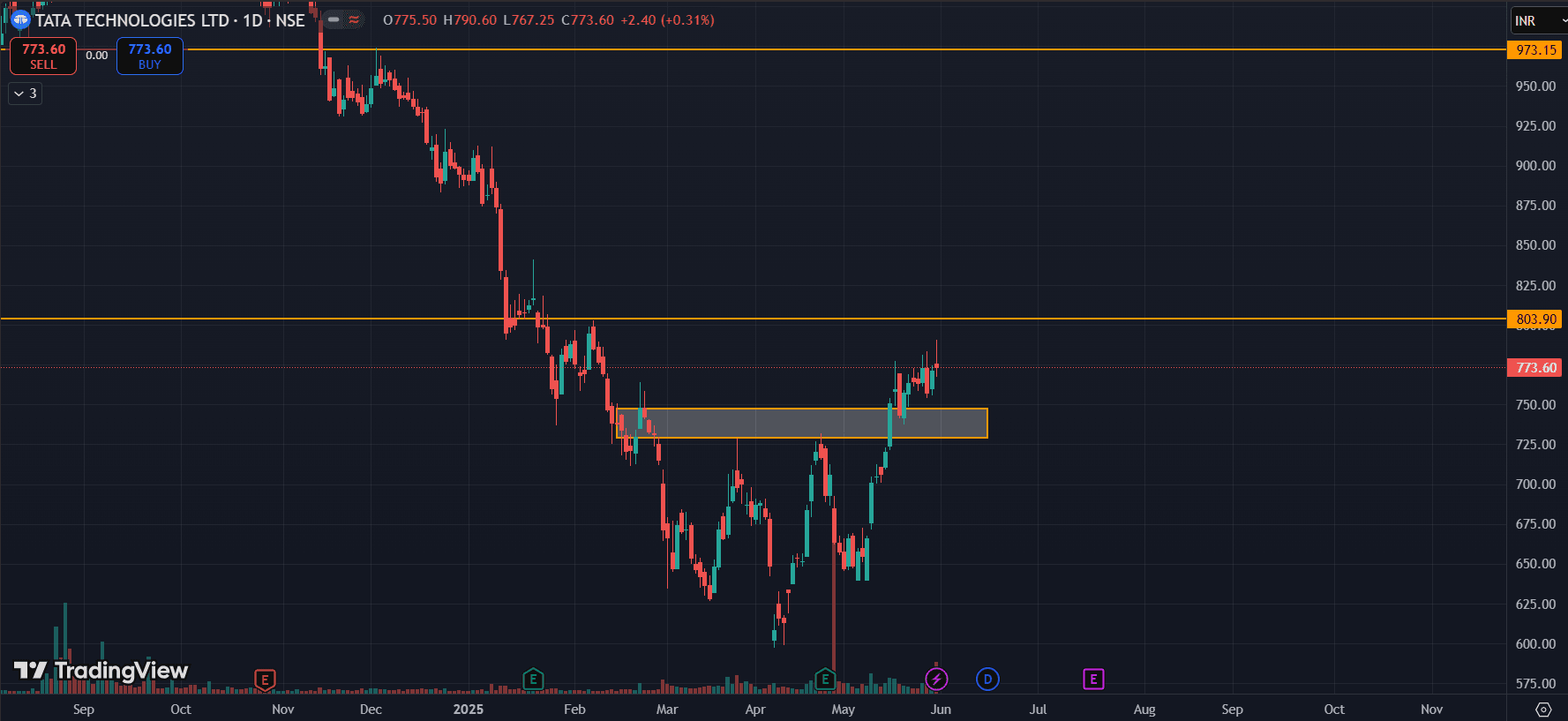

1. Tata Technologies

The stock has broken the consolidation at around the 750 price level and is sustaining above that. If it makes a breakout above the 804 level, then it must be on the buy list for around an 8-10% up-move.

Financials Stats:

The PE ratio is 46.4, which is almost around the median PE of the industry.

The company has also shown a good profit growth of around 21% in 5 years.

2. Motilal Oswal Financial Ltd

The stock has consolidated for a few months at around 650 levels, and then it has given a breakout from that consolidation zone and started its upward trend. The stock still has a lot of upside left and is a good option if one wants to keep it for the long term. If it sustains above 810 price levels or shows an uptrend, then one can think of making a position in it.

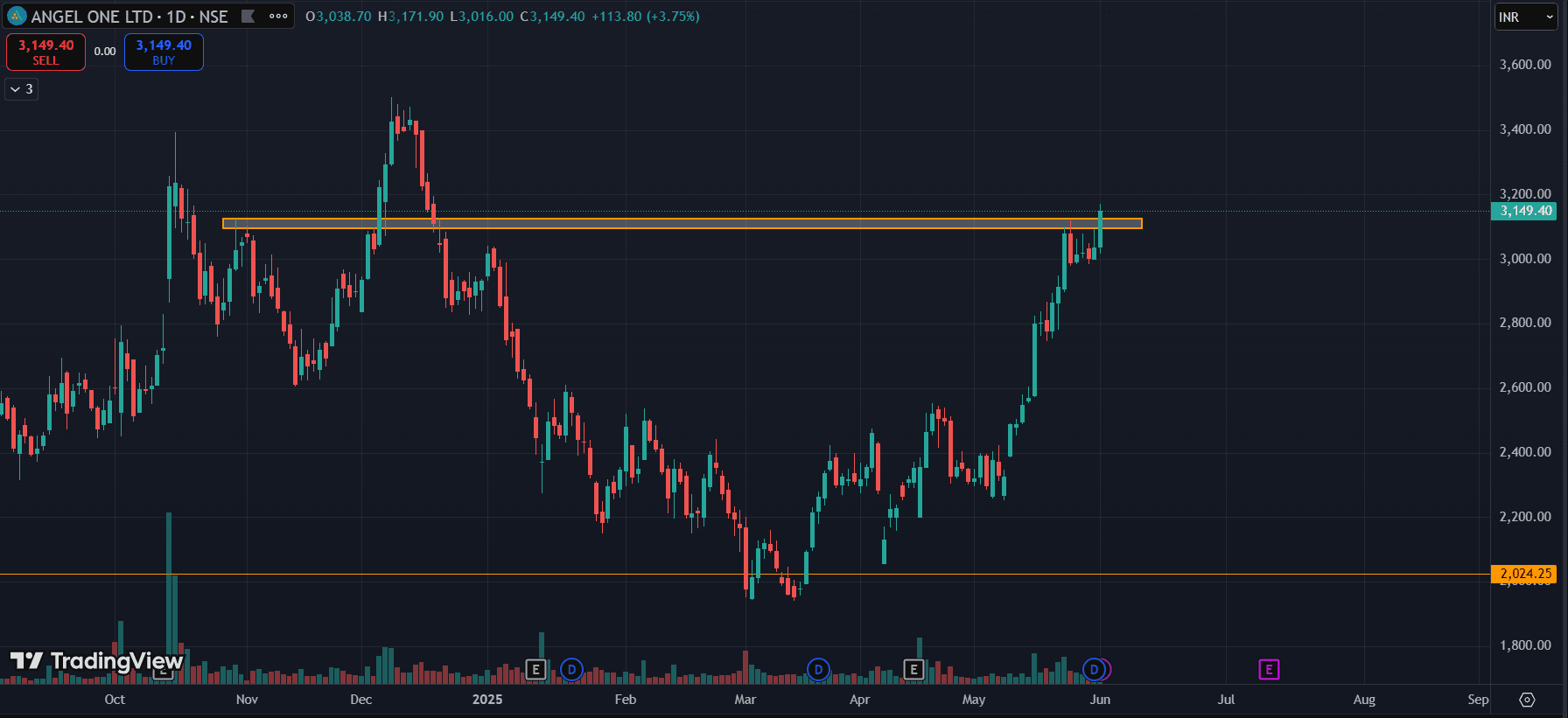

3.Angel One Broking Ltd

The stock has recovered from its lows and is making an upward move in daily and weekly TF. If it sustains and breaks above 3180 levels, then it’s a buy opportunity.

Financials Stats:

The stock is trading at PE value of 24.3 and has shown good profit growth of around 67% in 5 years.

FII’s/DII’s also have a combined 27% holding in stock.

Recently, the stock gave a dividend of Rs 26/share as well.

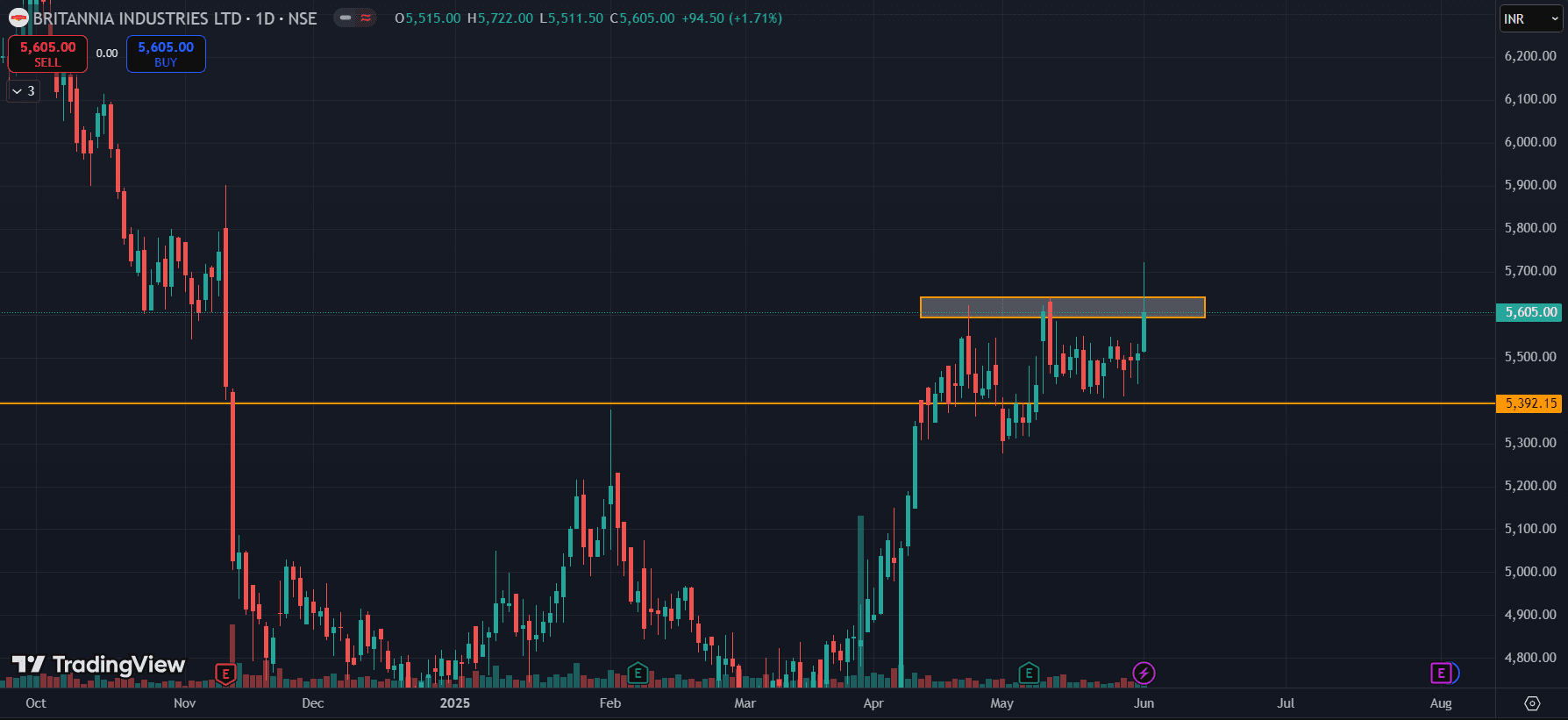

4. Britannia Industries Ltd

The stock is a promising bet for the long term. Currently trading around 5605 levels. If it gives a closing above 5648 levels on daily TF, then it can be considered as a Buying option. The stock has good fundamentals and is currently trading at a PE value of 61, which is slightly lower than the industry PE of 74. The sales and profit growth of the company has not been good, i.e., around 9% in the past 5 years. The company has a dividend payout of around 80%, and it has recently declared a dividend of Rs 75 per share.

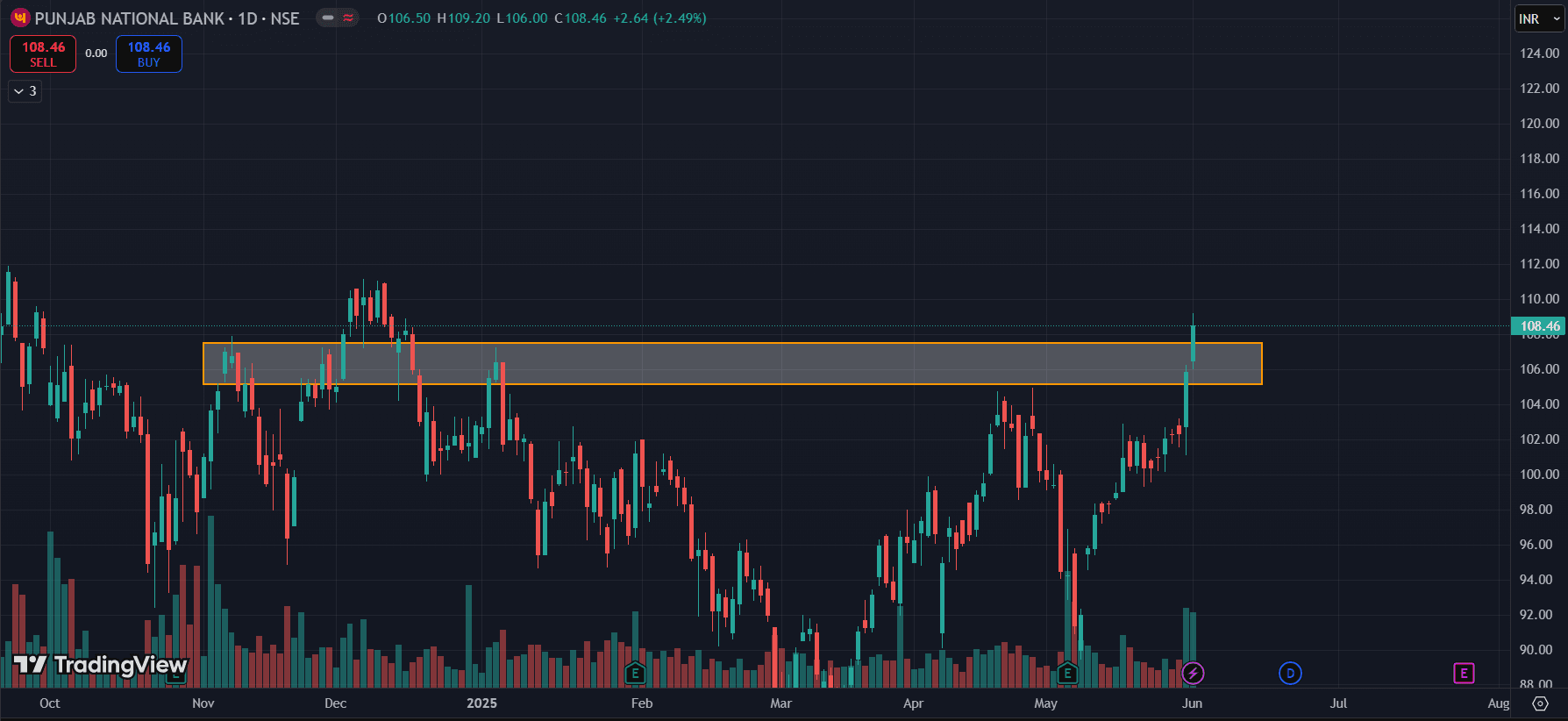

5. Punjab National Bank

The stock is trading at 108 levels and has given a HH formation from the previous level. If it sustains above 111 levels for a while and provides a newer breakout from that range, then this stock will be under a buying option as it’s still 22% from its ATH.

The stock is a PSU bank with a PE value of around 6.75.

The stock has recently declared a dividend of Rs 2.90 per share.

Thanks for reading. Hoping this blog has helped you gain some insights and learning about the stock market.

Stay tuned for more such content and connect with us for suggestions or advice here.

Disclaimer: The information provided in this article is for informational purposes only and should not be considered financial, investment, or legal advice. Always consult a qualified financial professional before making any investment decisions. Investments are subject to risks, and past performance does not guarantee future results. We are not responsible for any financial losses.