Hello readers, welcome to another blog on swing & positional trading strategies. Engaging in Swing and Positional Trades strategies can be a fundamental part of your long/term investing. I took the following trades in the month of November in the Indian/European stock markets, and most of them have given a decent return in just a month.

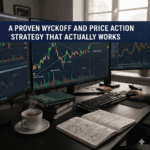

CUPID Ltd

A trade opportunity arose after a breakout from consolidation around the 260 level, with a higher high indicating a shift in market control to buyers and strengthening bullish momentum. This stock, which has provided over 200% returns this year, was on our radar due to its business growth and profit increase. It remains a positional trade with decent profits, and we will exit only upon consolidation above or a trend reversal.

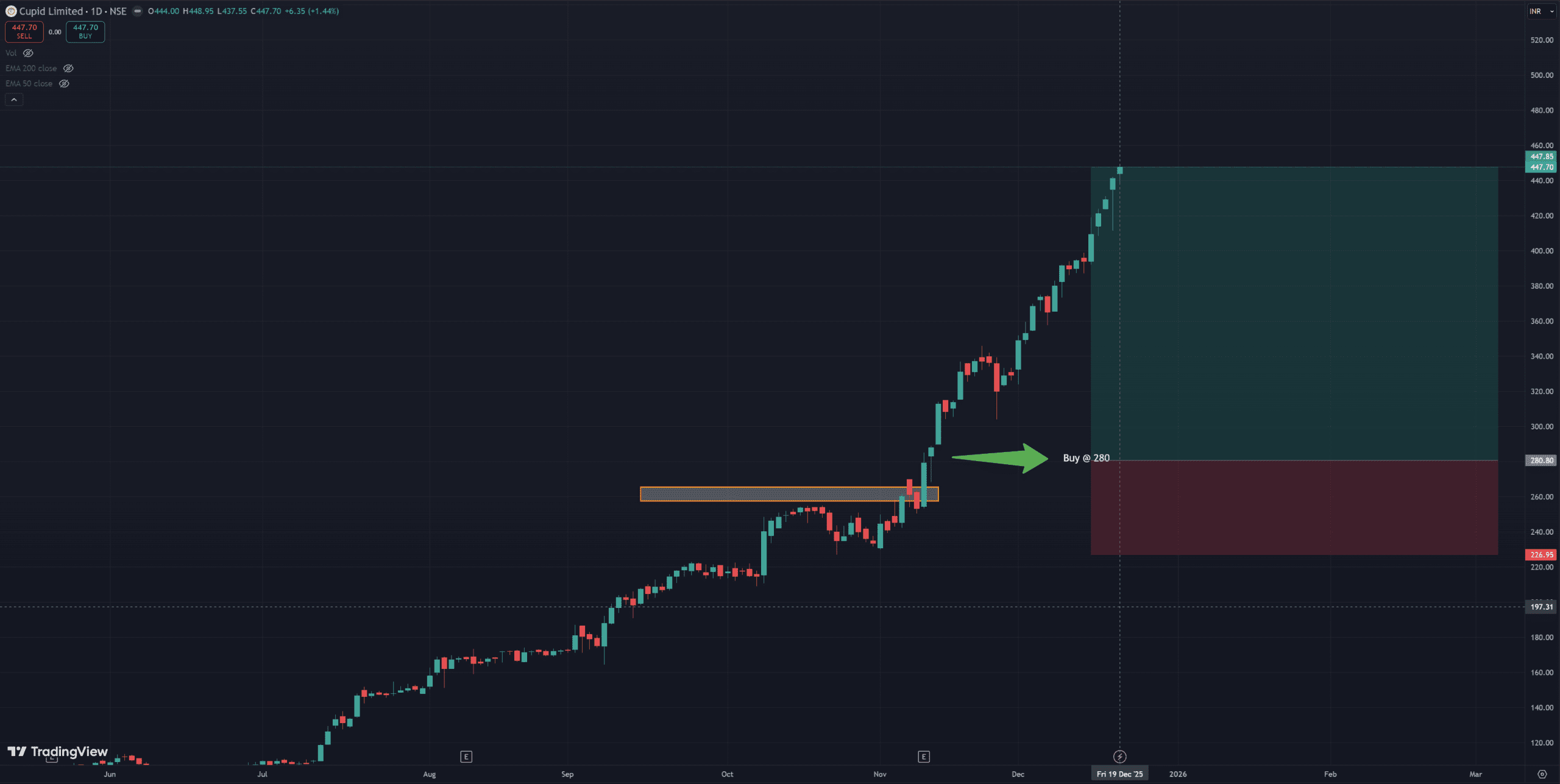

INFOSYS Ltd

This stock was also bought around the breakout from the consolidation zone and also when the company also announced the the news about its BuyBack offer for tender shares around 1800 levels. Also the buyback news gave a breakout in the stock from around 1500 levels, which was a clear indication that the price is going to rise further. Took part in this trade after the breakout of 1500 levels and still riding the gains.Partial quantity was booked in buyback offer which accounts for almost 18% returns. The remaining quantity is trading at around 8-9% gains which is decent from Swing trading perspective.

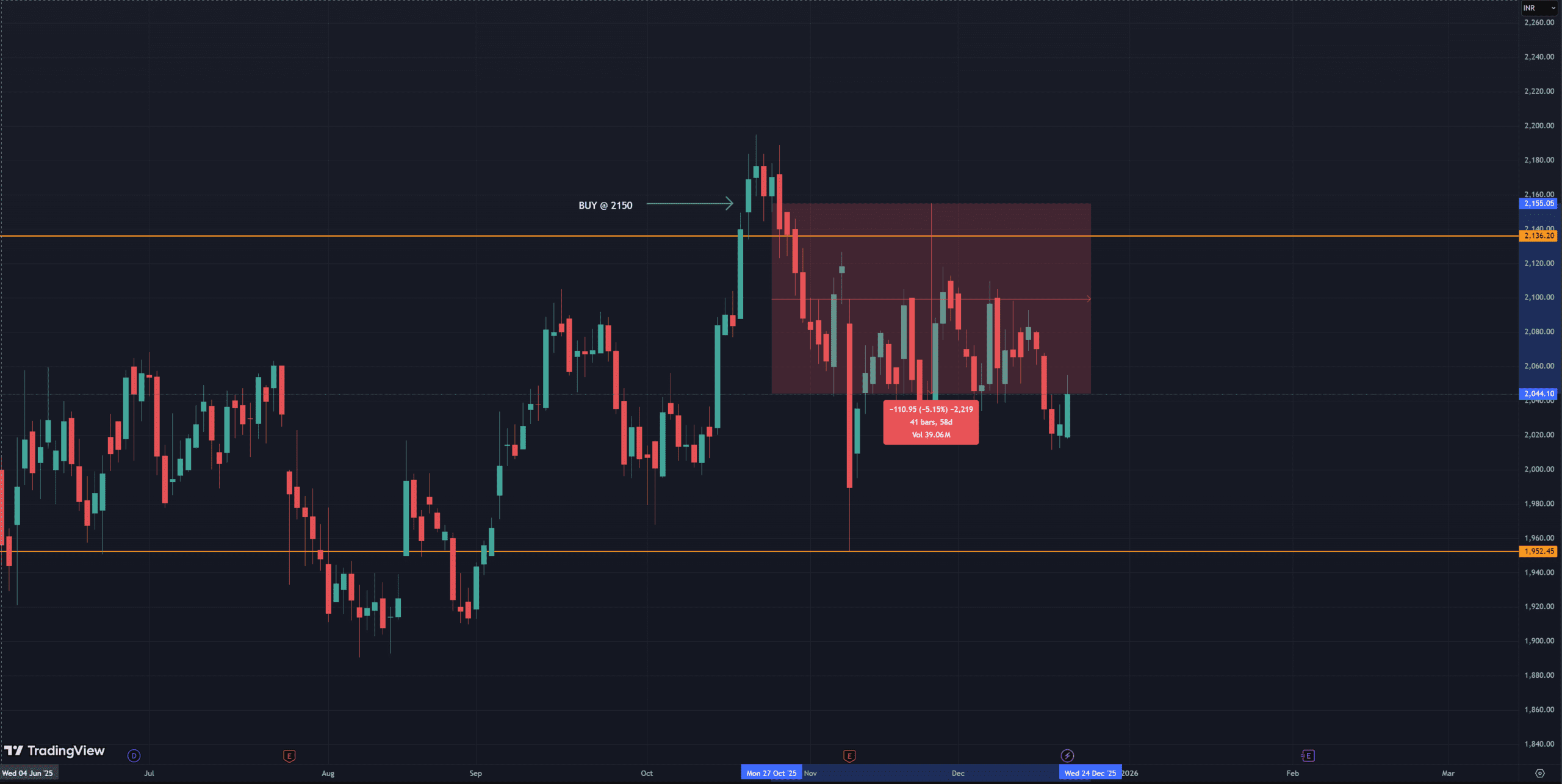

Bajaj Finserv

This trade was taken around 2150 levels with the breakout of the previous high and new HH formation. but the breakout didn’t sustain, and the price reversed. The reason for price reversal could vary, from global cues to changes in banking and NBFC regulations, etc. We did not need to take much of that into consideration, as we follow price action as the sole indicator for our trade. The position is still in trading portfolio and it is currently giving us a negative return of around 5%, and the stoploss is set to around 1950 levels, which is almost 8-9% for a stop loss in swing/positional trade.

This was all from the November swing/positional trades. Generally, in Swing trading, we expect gains of around 5-7% in a few days or a week, as the trade duration is short. In Positional trading, we take around 10-20% gains as decent gains, as we are going to hold the trade for weeks or even months. The main underlying principle used for swing and positional trades is Wyckoff method and Price action movement. If you would like to know how I use fundamental principles and price action movements to select stocks for Swing/Positional trading, click here to read my previous article on Wyckoff Method.

If you like reading our posts, do follow us on Instagram for quick updates.

Thanks for reading. Hoping this blog has helped you gain some insights and learning about the stock market.

Stay tuned for more such content and connect with us for suggestions or advice here.

We wish you Merry Christmas 🎅 and in advance a very Happy New Year. Stay Profitable✌️

Disclaimer: The information provided in this article is for informational purposes only and should not be considered financial, investment, or legal advice. Always consult a qualified financial professional before making any investment decisions. Investments are subject to risks, and past performance does not guarantee future results. We are not responsible for any financial losses.