NVIDIA is a technology company that primarily designs and develops GPUs(Graphic Processing Units). GPUs are high-performance processors mainly used in gaming, AI, and machine learning applications.

In addition, Nvidia also provides CUDA software and APIs that allow the creation of massively parallel programs that utilize GPUs and are deployed in supercomputers. NVIDIA sells its products to PC manufacturers, game console manufacturers, and data centers.

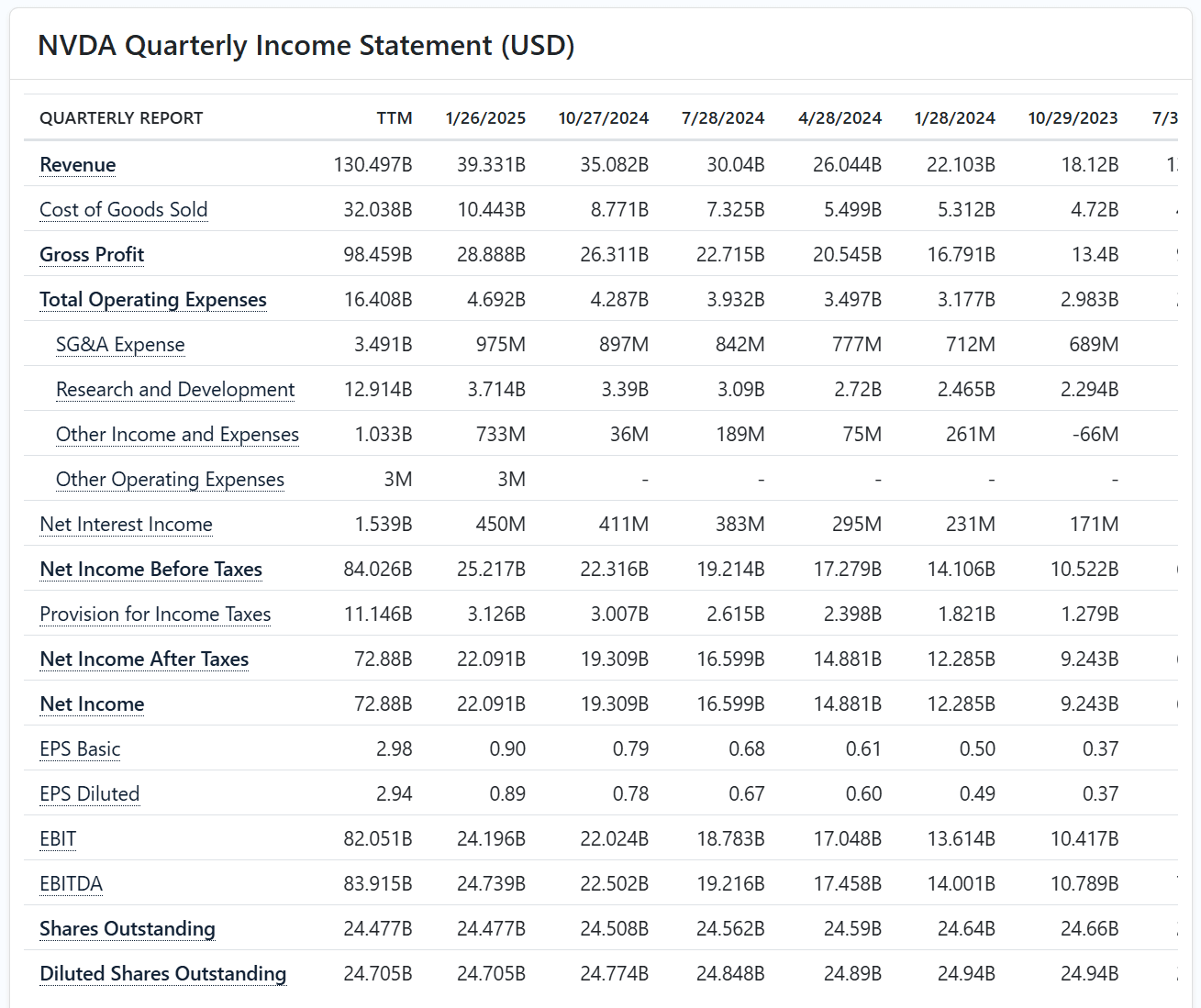

Let’s take a look at the stock’s financial performance in the previous year-

- The stock is roughly down 23% from its all-time high.

- The year-on-year growth in revenue of stock is around 114% from $60 billion in 2024 to $130 billion in 2025.

- The net income grew by 144% from $29.7 billion in 2024 to $72.8 billion in 2025.

- The quarterly growth is also around 77.9% in revenue growth and 79.8% in net income growth from same quarter last year.

Factors affecting NVIDIA’s stock performance-

- Advancement in AI –

With the introduction of a new and efficient AI model called DeepSeek by China in January 2025, Nvidia stock saw a selloff of around 22% from a price range of 148 to 116.

As the competition in AI is increasing, tech giants like Microsoft, Google, and Amazon are increasing their capital expenditure in developing and improving AI infrastructures.

As per claims, DeepSeek AI is a more resource-efficient model. - Trump’s Tariff-

The US market is experiencing a selloff due to the introduction of new export policies by the US government by implementing a 25% additional tariff on imports from Canada and Mexico and a 10% additional tariff on imports from China.

There could be a direct impact on the profitability of the stock in the coming future due to this trade war as Nvidia depends largely on TSMC(Taiwan) for chip manufacturing and its revenue from Asia contributed as much as 47% in FY2025. - Stock Chart Analysis-

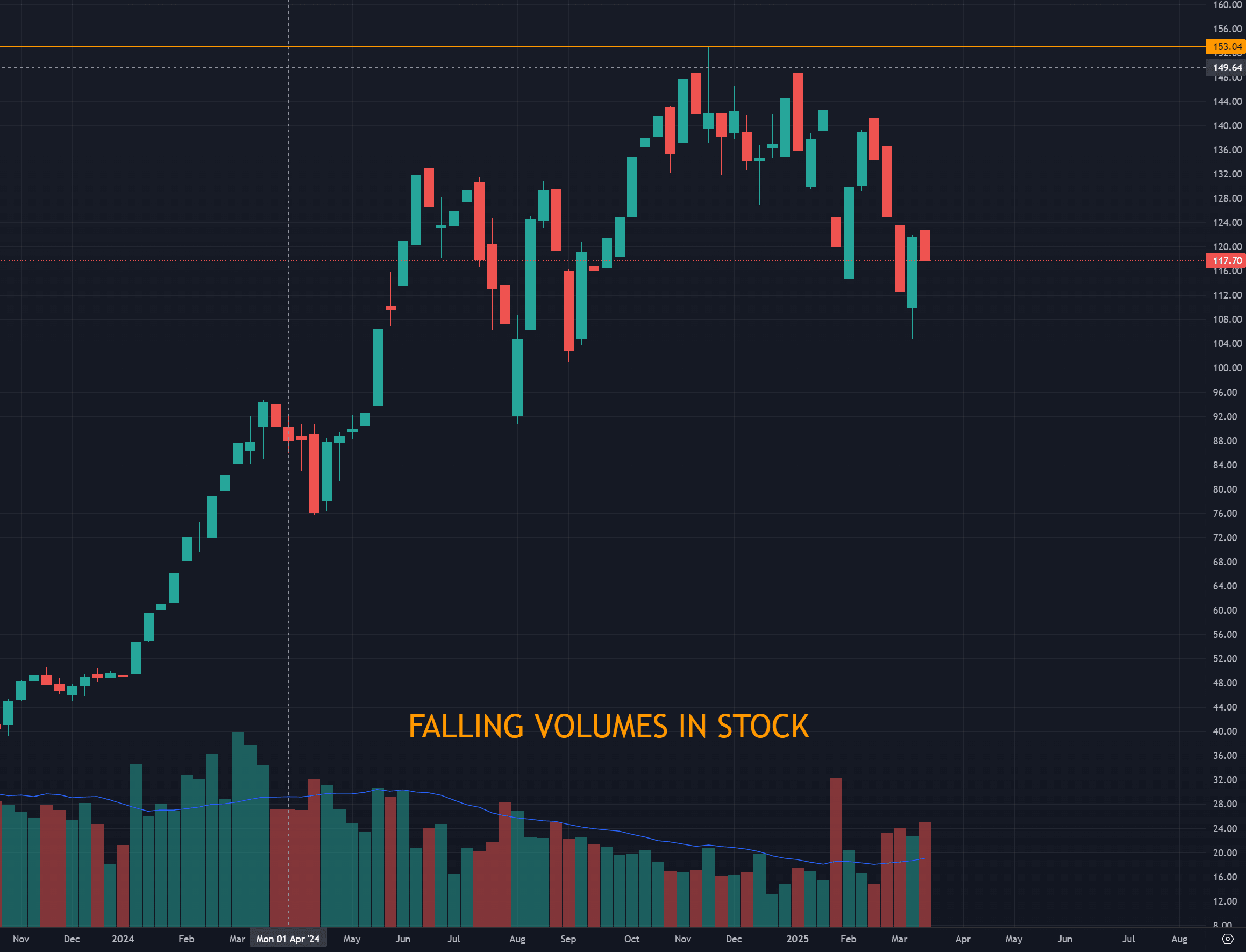

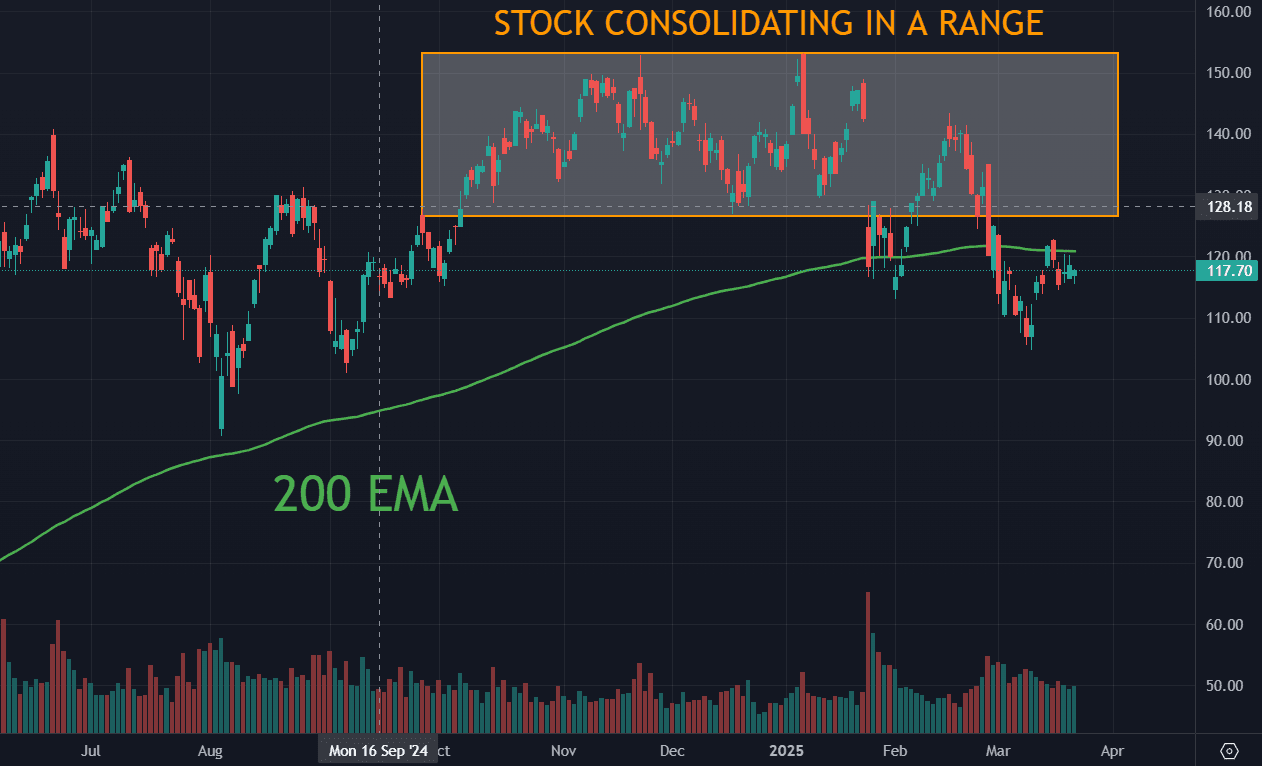

The technical charts indicate a momentary pause in the growth of the stock price.

The stock is trading below its 200EMA, which indicates a bearish sentiment in the stock.

- The weekly chart shows that the stock is unable to break its previous High i.e. 153 and there are no newer HH and HL formations. The stock is currently in a consolidation phase with Volumes also decreasing.

- The Daily chart also shows consolidation in stock price with the price breaking the 200 Day Moving Average line(200 EMA). The stock price breaks down the 200 EMA around $120 price, then followed with a re-test to break it in an upward direction, and finally facing resistance around the same level.

- The breakout of stock price above 200 EMA is considered Bullish and break down below 200 EMA is considered Bearish.

More thoughts on this-

With the fear of recession looming in the US economy, it becomes very uncertain to predict the stock future.

There are a lot of uncertainties going around the world, in finance, geopolitics, etc. and the market doesn’t like that at all. Hence, it becomes a bit risky bet to invest in stocks that are directly impacted by it. As long we don’t get a clear way forward with this, it becomes more important for us to make cautious decisions with our investments.

The stock has a good potential and a solid business to follow up (must watch Nvidia’s March keynote). Despite newer competition arising, and tariffs impact, the stock will still be capable of making good growth in its business in the future.

Let me know your thoughts below on comments on whether you plan to buy, sell, or hold your positions in the stock.

Disclaimer: The information provided in this article is for informational purposes only and should not be considered financial, investment, or legal advice. Always consult a qualified financial professional before making any investment decisions. Investments are subject to risks, and past performance does not guarantee future results. We are not responsible for any financial losses.

The stock’s financial performance this year seems promising compared to last year. It’s interesting to see how the company managed to recover from earlier challenges. Investors might feel more confident considering the positive trends. What factors do you think contributed to this improvement?

The stock showed significant growth last year, with impressive quarterly earnings. Many investors are optimistic about its future potential. It’s crucial to analyze the factors driving this performance. Diversification seems to be a key strategy in its success. What specific trends contributed to this financial outcome?