Price Movement and Market Cycle

Stock prices move in a certain pattern. The market follows a cycle after a predicted event, which is based on broader sentiments. Understanding these movements or cycles can help us gain an advantage over stock price predictions. Identifying these price movements will help us make-

- better and more informed market positions

- reduce total risk

- improve our return on investment

There is a very well-known and powerful method that discusses the stock movement, by focusing on the market cycles and patterns. This method is known as the Wyckoff Method.

Below, I will summarize my understanding of this method using easy-to-follow text and some practical market examples. So, let’s start…

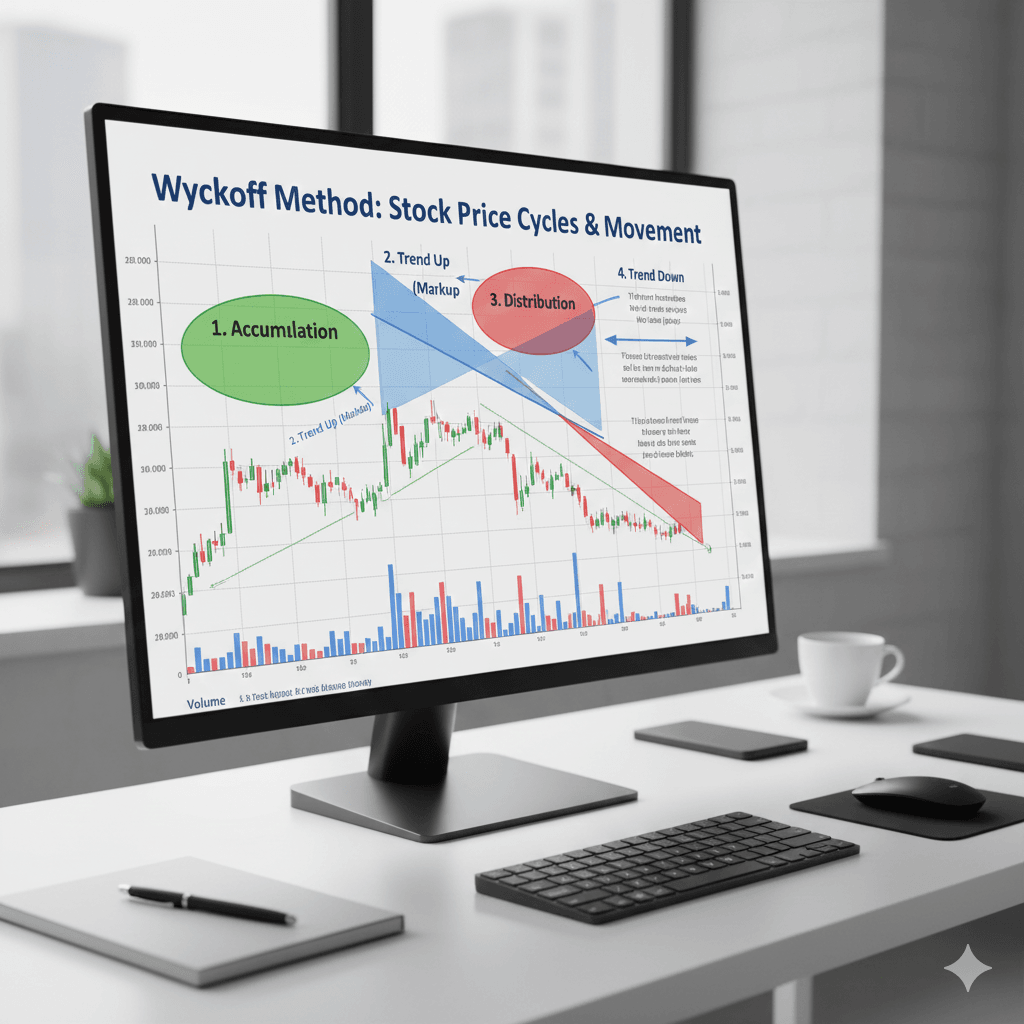

Wyckoff Method

It is a trading strategy created by Richard D. Wyckoff in the 20th century. It is based on three main laws-

- Law of Supply and Demand– The law states that prices go upward when more buying occurs and fall down when there is selling pressure.

- Law of Cause and Effect– This law states that a big buildup or longer consolidation in prices leads to a bigger movement.

- Law of Effort vs Result – The change in trading volume should match the price movement. If both volume and price match, then it is a strong trend.

– Don’t expect the market to behave the same way.

-Today’s market behavior is determined by what the market did yesterday, last week, or last month.

-Wyckoff Method is by far, one of the best-known methods to predict and analyze stock price movements.

– Nothing is definitive but can only be predicted to some extent. The stock market works on human emotions, which defines the market sentiments.

Generally, the price movement happens in any stock when some big players want to buy or sell a position in it. According to this method, the market generally moves in 4 major phases, which capture these price movements.

1- Accumulation Phase

2- Distribution Phase

3- Markup Phase

4- Markdown Phase

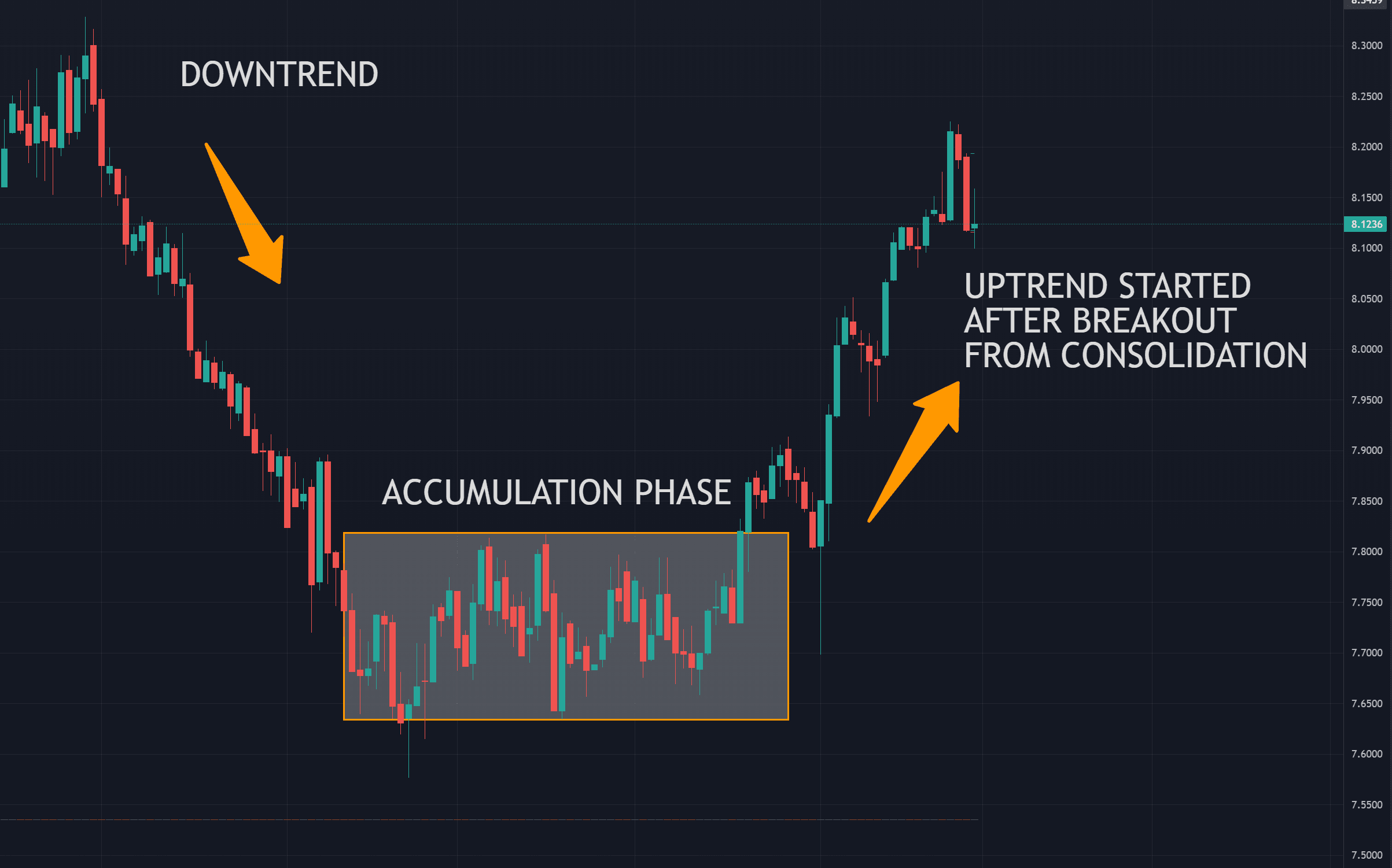

1. Accumulation Phase

After the prices drop in any stock stops, it tends to enter a consolidation or accumulation phase. When any big player starts building a position in stock, it happens slowly over some time. This is done to prevent everyone else from jumping into the stock and making the stock price rise too fast.

The big players slowly start accumulating the shares. There is also a significant increase in volume during the accumulation phase.

As the stock price moves in a range, the stock makes a series of highs and lows within that range.

The longer the price stays in that range, the higher the chance of price giving bigger targets after breakouts.

Image 1. Accumulation Phase after a downtrend in SEK-INR currency Chart(1D)

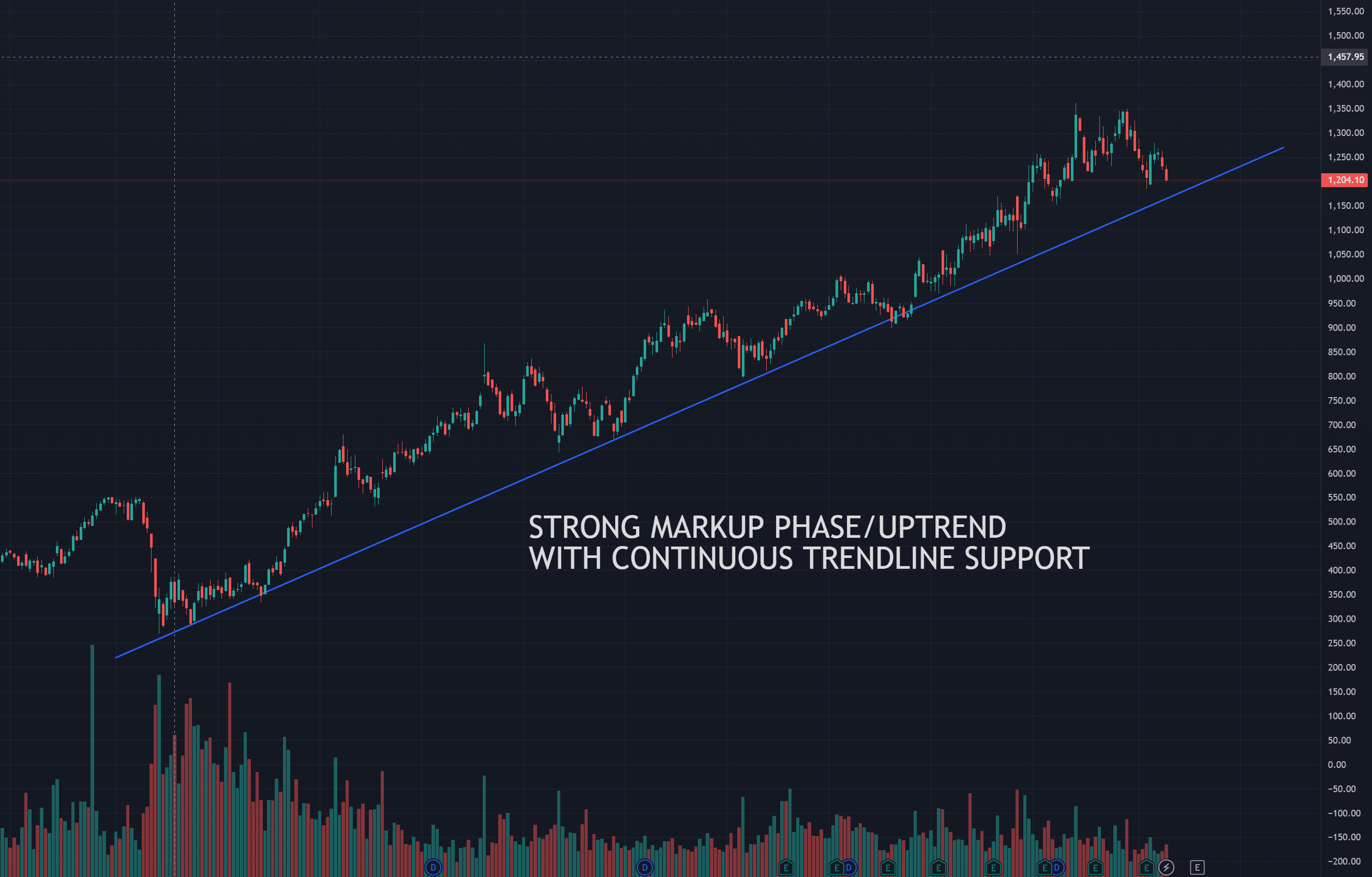

2. Mark Up Phase

Once the accumulation of shares is completed, the buyers want the prices to go higher. The prices tend to break the accumulation range and go into the next phase called as a Markup Phase or an Uptrend.

In this phase, once the accumulation range breakout happens, then the price starts forming a series of Higher highs and Higher Lows. The HH and HL formation is the key to identifying the uptrend in a stock.

An uptrend can also be confirmed with the help of a Trendline.

Once the uptrend starts, the stock becomes noticeable and then the retail traders also start joining this trend to gain a quick move.

Image 2. Series of Uptrend, Accumulation and another Uptrend in HDFCAMC(1D)

Image 3. A strong uptrend or Markup Phase in ICICIBANK(1W)

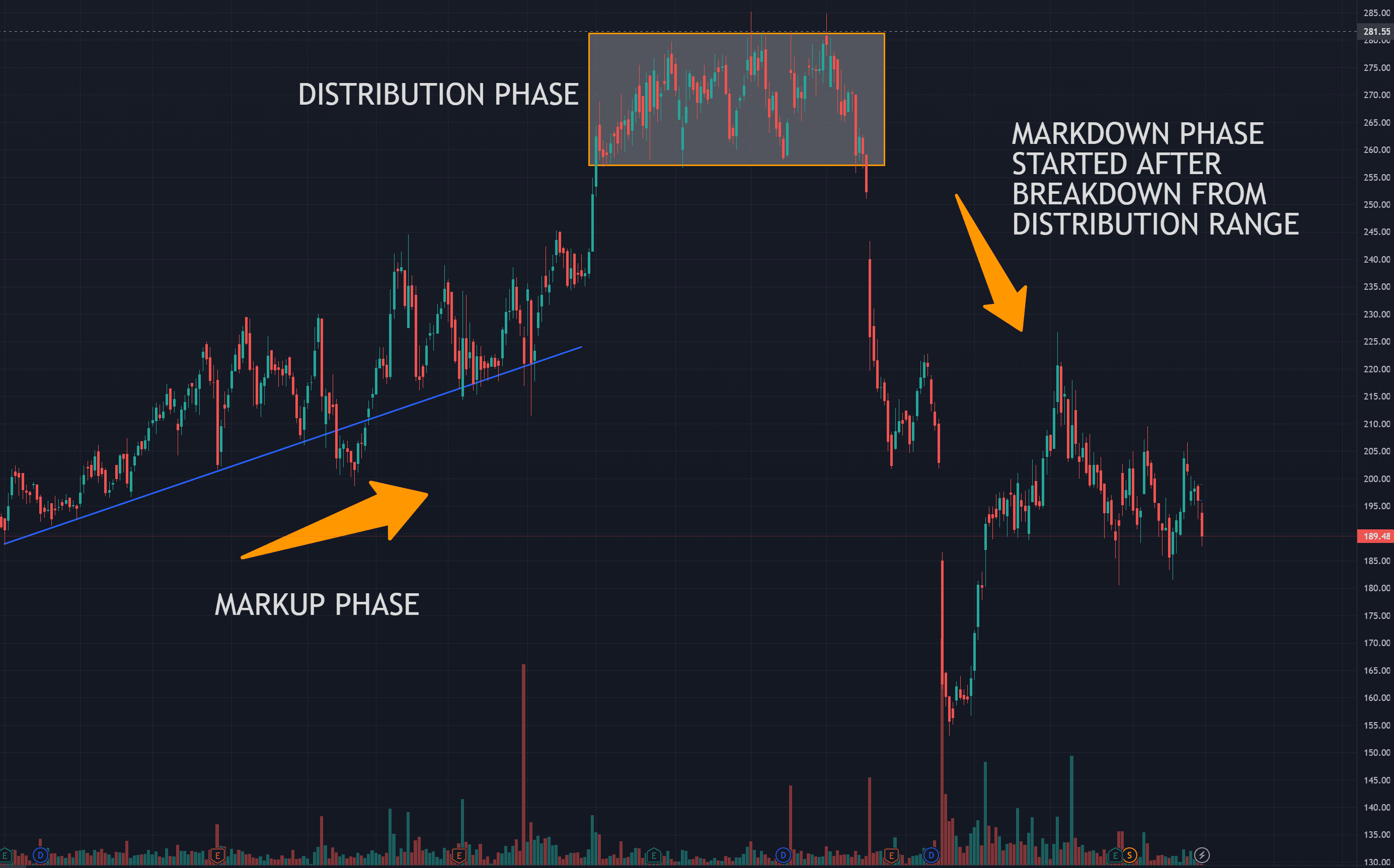

3. Distribution Phase

Once the up-move in stock is done, the big players will try to sell their positions at higher prices.

The selling also happens gradually over time and within a range to prevent the stock price from falling too quickly. The stock moves in a sideways pattern and it further stops making newer Higher Highs and Higher Lows. We can easily see a change or a bend in the trend of the stock.

There is always a buying and selling tension during this phase between new and existing investors.

Image 4. A strong downtrend after the breakout from the Distribution Range in IGL(1D)

4. Mark Down Phase

Once the selling pressure overpowers in the distribution phase, the stock price starts falling. The distribution happened over a range and we can notice a breakdown of the price from that range.

The stock falls with characteristics of forming Lower Highs and Lower Lows. Once the stock reaches the bottom or is in the over-sold region, then it again begins from the accumulation phase followed by the other phases thereafter.

Image 5. A downtrend or Markdown Phase after consolidation at top in TATAMOTORS(1D)

These 4 phases keep on repeating after each other and not necessarily in the same order. One needs to carefully identify these phases before making any position in stocks.

Additional Tips

- Always check the current trend and market sentiments first before making positions in any of these phases. If the market is in a downtrend and you tend to enter a breakout from the accumulation range, then there are higher chances that the breakout is a false breakout.

- Select and choose only those equities or instruments that harmonize with the broader market trend.

- Check all the parameters before making any entry, like breakout or breakdown from range, HH or HL formation, volume spikes, and so on.

- Always follow the rules or principles you made for your trading style, alongside strict Target and Stop Loss settings. Do not fall into fear or greed, and never let your emotions overpower your logic.

- Do not try to average a stock price in a downtrend. Check fundamentals and company financials before. Because a stock doesn’t fall too fast without a solid reason.

- Choose a trading timeframe that suits you. For ex. Intraday(5m or 15m), Swing(1h or 1D), Positional(1D or 1W).

- The price generally moves as the big players enter the stock. As a retail trader or investor, one’s goal should be to align with the buying or selling of these big players to be on the profitable side.

Do you have any other investment topics or stock analyses that you want us to cover? Contact us here or comment below.

Pingback: Profiting from Swing and Positional Trades: Nov 2025

Pingback: A Proven Wyckoff and Price Action strategy that actually works – TheGuidedFinance