In this blog, I am going to explain the Wyckoff method and Price action strategy that I use in my all Swing and Positional Trades. I will take you through some live trade examples and the return it generated over a small time period. Also we will use this strategy, to find out when is the best and most probable time to enter any trade and when its time to book profit before the trend reverse. The trades I will be taking are all Long trades, which means we are only dealing with positions that will be Cash and Carry (CNC) and no short positions and no Options are traded. So lets get started…

Let me explain you the basic of Wyckoff Method first in few simple steps. According to Wyckoff method, the market generally moves in 4 major phases-

1- Accumulation Phase

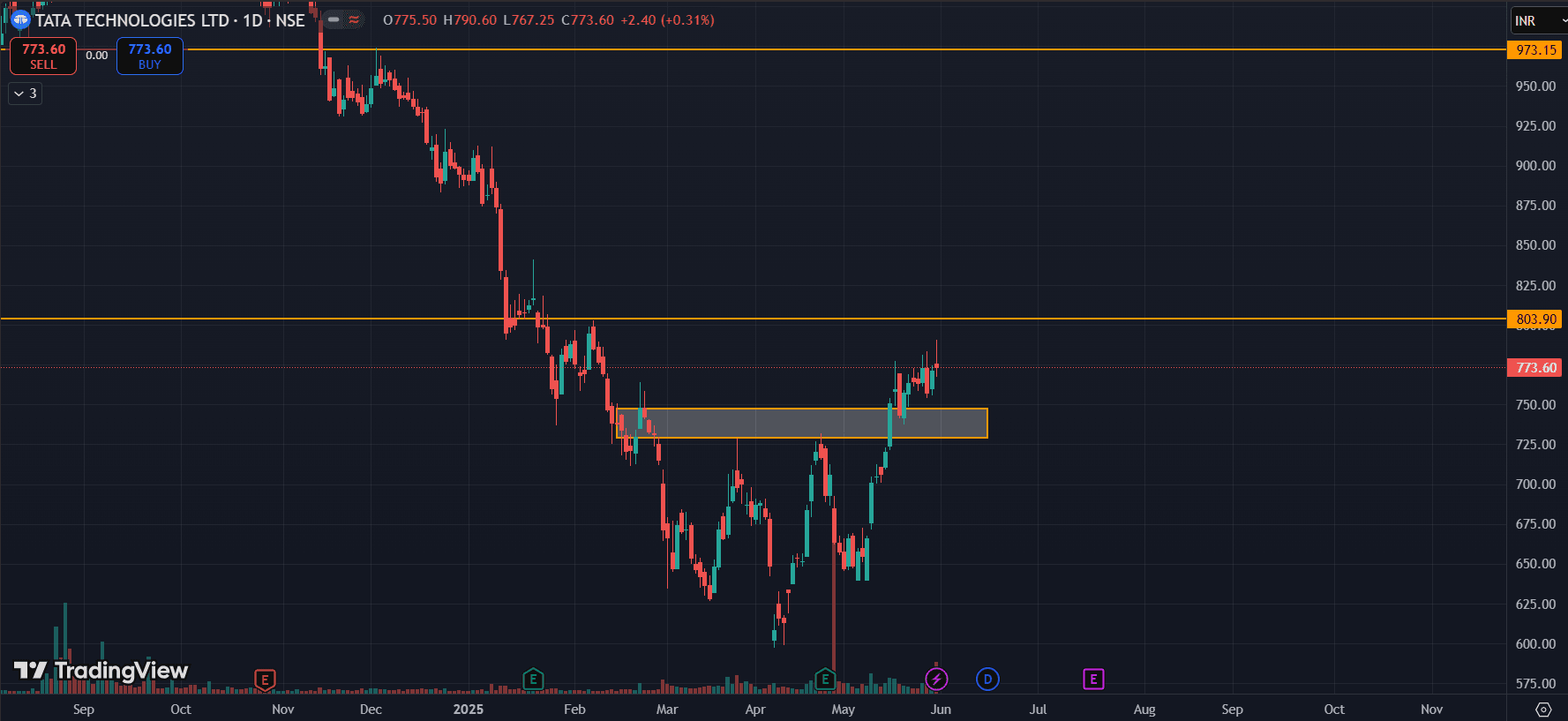

2- Distribution Phase

3- Markup Phase

4- Markdown Phase

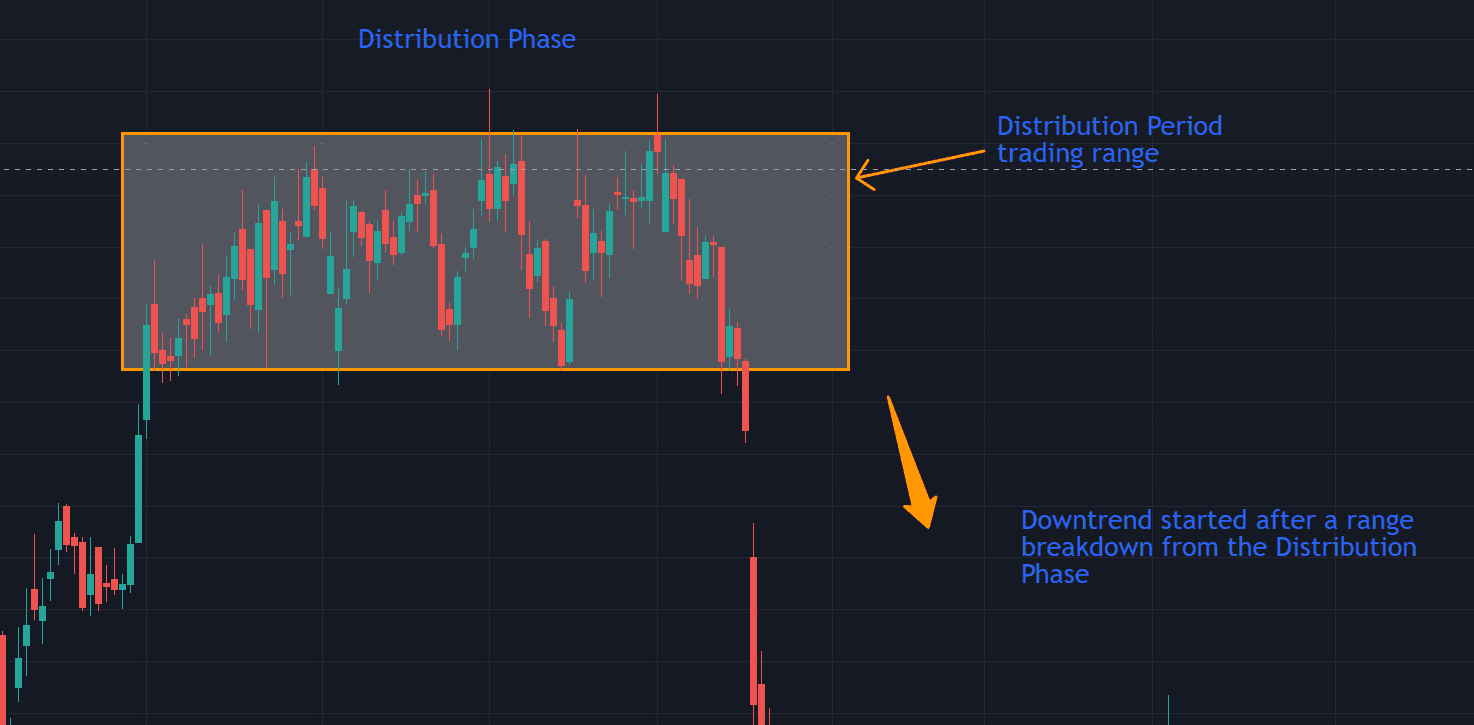

Accumulation Phase generally happens at the bottom, when the price is about to start a new trend or up-move. It is the phase where all the accumulation of stock is happening by everyone, and possibly by big players, before any big news comes out in the stock. But we cannot wait for the news, we need to see this formation when the stock is consolidating and refuses to make any further Lower The Lows in the market. This is the time when the up-move in the stock is about to start.

This accumulation phase can last for days, weeks, or even months. But the main thing is when the breakout from this phase happens. That is the point where we should be actively tracking this stock to make our long positions before it gives a further up-move.

The similar behavior can be seen in Distribution Phase as well, but its its in the opposite direction, when the up trend is coming to halt or the market is about to start its downtrend. The price consolidation happens in similar manner in Distribution Phase as well, just the price stops making further Higher Highs and trades within a range. When that range breakdown, then the Distribution Phase is accompanied buy the Downtrend in stock prices.

Now we know about what is Accumulation Phase and Distribution Phase. We need to club it together with Price Action techniques to build our trading setup. If you understood this far, I hope are ready t uncover the next step which is more interesting, and the best part is that it actually works in any trading scenarios.

“Price Action is the King”

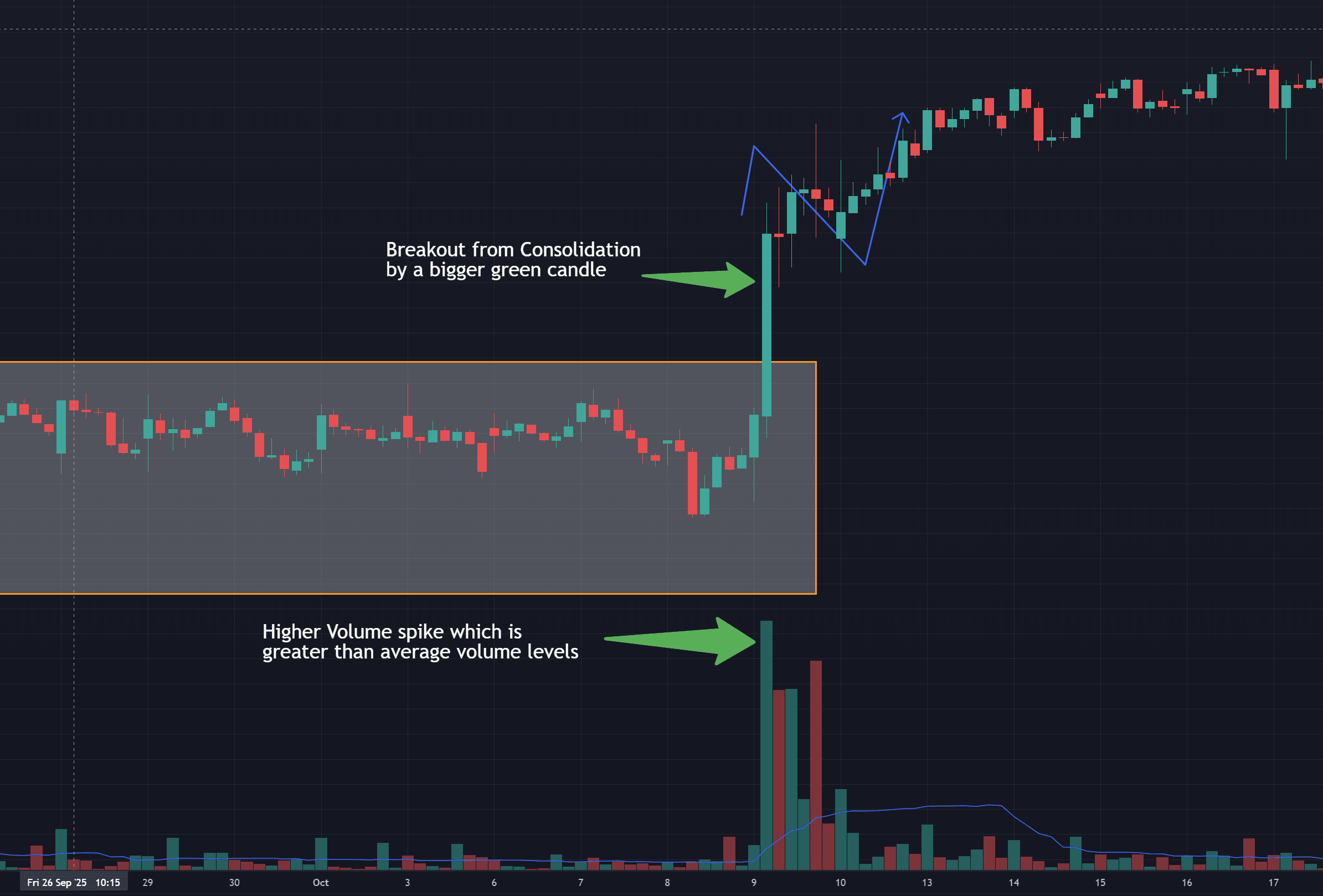

Now when we know that from accumulation phase, the price is about to give breakout. We need to make sure that we enter the stock only after confirming that the breakout has happened from the range and the stock is ready to move upward. The confirmation of breakout can be made either with the help of indicators like Volume indicator or Relative Strength Indicator(RSI). We can see that the volume graph is higher when the breakout happens than the previous volume candles. there should be strong buying indications from the volume chart.

Now that we have got a breakout candle, we need to figure out if this breakout is actual breakout or just a fake breakout used buy Big Players(DIIs, FIIs, Institutional Investors, etc) to trap retailers like us in the stock. Which results in a stock price reversal to much lower levels and it will hit the Stop Loss.

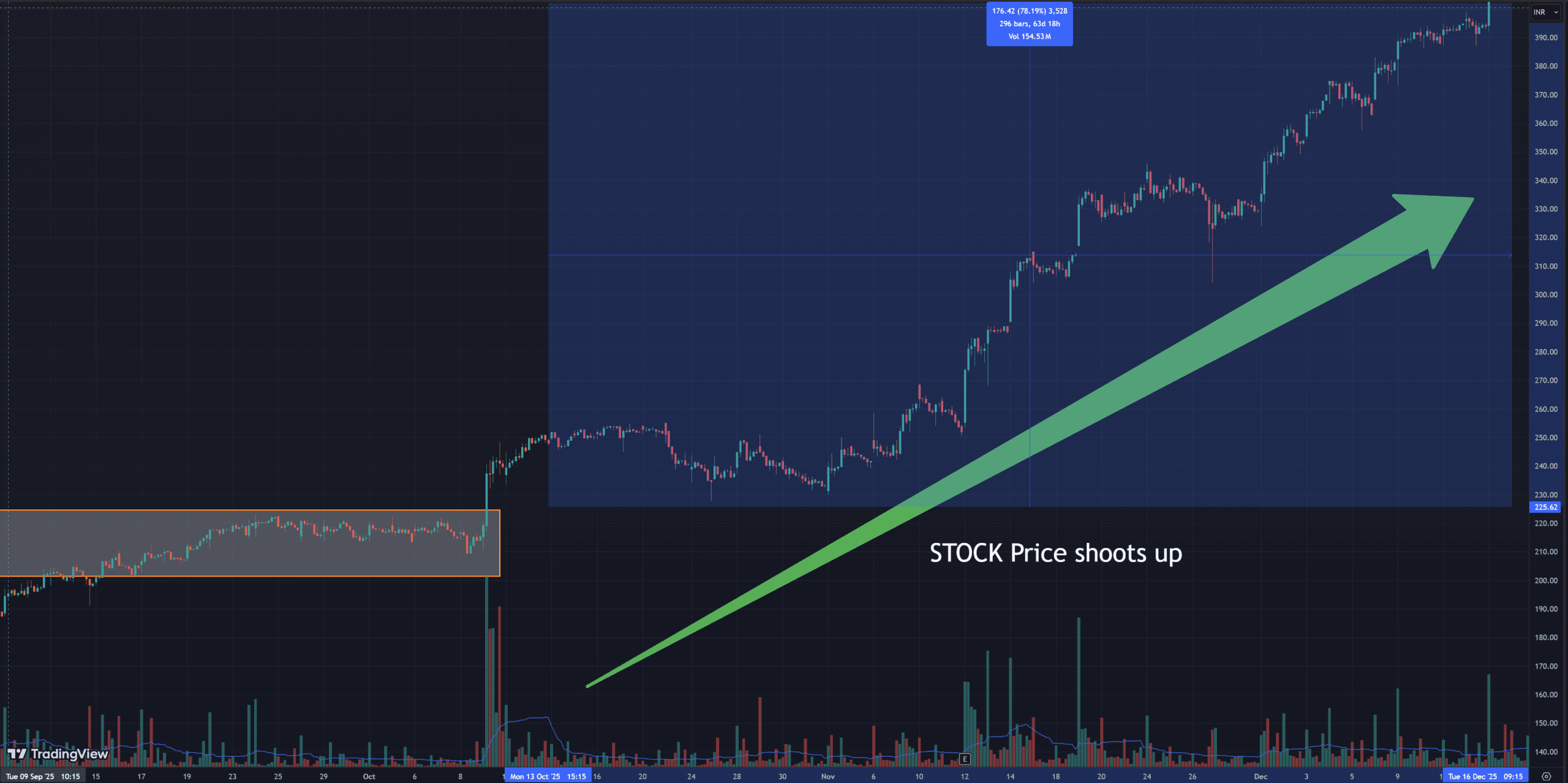

We will try to see this with the same example used above from CUPID Ltd. I will show you what happens after this breakout and what could be our possible entry and exit levels.

So what happens next?

The price sky-rocketed after the breakout and gave almost 70%returns in few days.

Now the question is would it be possible for you to catch this rally? Would you had not panicked when the stock came back to your buying levels in the beginning and then took support at the breakout level again and then it moved upward? Yes, you would not be able to catch this enormous rally if you would had not known few things before entering this trade after the breakout.

So, I am going to list few important points below, which if you follow, will help you make a profitable return from every trade and you will be able to catch the most part of it before it reverses from the top.

So here is the checklist, before every trade.

- Always keep your Target level in mind. Do not change it unless its absolutely necessary to do so. If you are taking part in Swing Trade, keep 5-7% as target returns from the trade and exit immediately if the target price is achieved.

In Swing Trading, I always prefer to keep my ROR around 5-7% and in Positional Trading it is around 10-20%. Do not fall in the trap of expecting the price to go higher even if your target is achieved and then all of sudden the stock price reverses and puts you in FOMO and you tend to disturb your trading mindset and end up making loss on the trade instead of booking profits. - Always define your STOPLOSS before you enter any trade and never change it. This rule should be followed strictly and should not be broken. Always keep logical stoploss in your trade and not just some random stock price levels.

- Check for Support and Resistances in Higher Time Frames. Suppose, if you are taking a swing trade in 1H timeframe and then there is a resistance level before your target level in daily time frame, then that level has to be marked already and trade should be only taken if you are getting your target price before that level. Otherwise you should try to take entry into the trade after that support level in daily timeframe is taken out and price is sustaining above that level for some time. Same goes for Support levels as well when taking a sell trade.

- Don’t be Greedy and avoid checking the stock chart again and again once you have booked your profits for the day.

Greediness is one of the easiest way to loose money in the stock market.

“Discipline is rewarded in the stock market—follow your rules, and results will follow“

I hope this blog helps you in gain some insights and learning about the stock market.

Stay tuned for more such content and connect with us for any suggestions or advice here.

Disclaimer: The information provided in this article is for informational purposes only and should not be considered financial, investment, or legal advice. Always consult a qualified financial professional before making any investment decisions. Investments are subject to risks, and past performance does not guarantee future results. We are not responsible for any financial losses.