Investing in real estate is one of the most reliable ways to build wealth.

Understanding the different types of real estate investments is crucial, whether you’re looking for long-term rental income, short-term profits, or passive investment opportunities.

Real Estate Investment types-

- Residential Real Estate

- Commercial Real Estate

- Industrial Real Estate

- Land Investments

- Real Estate Investment Trusts (REITs)

In this guide, we’ll explore the Residential real estate investment type and its potential benefits.

We will be taking the Gurugram Real Estate market as an example for including localities, builders’ info, registration charges, etc., but this guide will be useful for real estate investment in any city.

Residential Real Estate includes Single-family homes, Multi-family homes, Apartments and Townhouses

Residential properties are designed for people to live in and can be a great starting point for new investors.

Below we will discuss the steps to be taken care of before investing. So let’s start…

Steps to follow:

Step 1: Determine Your Budget

Before diving into a real estate investment, it’s essential to assess your financial capacity. Start by calculating the total capital you plan to invest, including your available cash, loan amount, and any potential financial support from family or friends.

Loan Considerations:

- Check your loan eligibility in advance by consulting a banker. Factors like income, CIBIL score, and existing loans will impact your approval.

- Request a loan quotation from the bank to get a clear picture of your borrowing capacity.

- Calculate the EMI you’ll need to pay for the loan amount.

- If your loan eligibility is lower than expected, consider including an earning family member as a co-applicant to increase the approved loan amount.

Additional Costs to Factor In:

Beyond the property price, account for extra expenses such as GST(under construction projects only), stamp duty, and registration charges, which typically amount to at least 10% of the property’s base selling price (BSP).

Step 2: Choosing the Right Location

Selecting the ideal location is a crucial step in real estate investment. Based on your budget, identify a locality that aligns with your purpose—whether for personal housing or investment.

Key Considerations:

- Connectivity & Infrastructure: If buying for residential purposes, ensure the area offers easy access to schools, colleges, markets, hospitals, airports, and major roads.

- Apartment Positioning & Facing: After selecting the locality, consider the placement and orientation of the apartment or house, as it impacts both comfort and future resale value.

- Premium Location Charges (PLC): Properties with better positioning, such as those with double balconies, park-facing views, or an east/southeast orientation, often command higher resale value. Even if these options come at a slightly higher cost, they can be a worthwhile investment.

- Whether you’re purchasing for self-use or future resale, choosing a well-located property enhances both livability and return on investment.

- As the saying goes, “Always plan your exit strategy before making an entry.“

Step 3: Connecting with Realtors & Brokers

Real estate brokers play a vital role in property selection. They not only help you explore different options but also provide valuable insights about the property, locality, and builder.

Why Work with a Broker?

- Market Knowledge: Brokers have in-depth information about property prices, upcoming developments, and the credibility of builders.

- Negotiation & Discounts: Many brokers have strong ties with developers and can help you secure additional discounts.

- Convenience: They streamline the buying process by shortlisting properties that match your requirements.

Important Tips:

Always work with a registered broker to ensure reliability and transparency. In certain markets like Gurugram, brokers can help you secure an extra 4-6% discount on the Total Consideration Value (TCV), depending on their relationship with the builder’s sales team.

Choosing the right broker can significantly impact your buying experience and financial savings.

If you don’t have any existing contacts with brokerage firms, you can start by registering on online platforms like Magicbricks, Housing, or 99acres. Simply enter your property preferences, including budget and preferred location, and browse available listings.

Next, express interest in a few properties that match your criteria. Once you do this, your contact details will be shared with brokers in that area, and they will start reaching out to assist you with property options and negotiations.

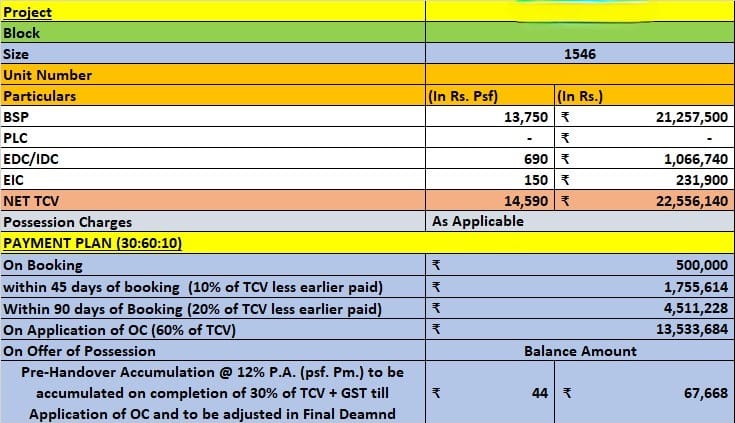

Step 4: Obtain a Property Quotation from the Builder’s Sales Office

Once you’ve selected a property and are ready to move forward, your broker will take you to the builder’s sales office to get a formal property quotation and detailed information. This discussion typically involves the builder’s Relationship Manager (RM), you, and the realtor.

Negotiation and Strategy:

- Request a Quotation: Ask for the official property quote from the builder. If you already have a price in mind, present it to initiate negotiations. Alternatively, if you need more time to consider, you can request a day or two to review the details and make your decision.

- Blocking the Property: If the property is in high demand, you can try blocking the unit by giving a cheque for the minimum token amount to hold the property, provided the builder agrees. This amount is generally refundable, but it’s best to proceed cautiously.

Research and Comparison:

Once you have the quotation, it’s important to compare similar properties in the area to get a sense of fair value or per square feet(psf) price in that area. Consider factors for comparison, such as

- Property type (e.g., comparing low-rise with low-rise in the same location).

- Amenities offered by different builders.

- Construction quality and total area (living space + super built-up area).

- Parking charges, community area size, and other fees(EDC, IDC, etc).

- Avoid comparing dissimilar properties, such as low-rise buildings with high-rises or properties in completely different locations.

Additional Steps- Analyze the Property

- Evaluate the Builder’s Reputation: Take time to research the builder’s track record. Look into their past projects, delivery timelines, and customer reviews. A well-established builder with a strong reputation can ensure the project’s quality and timely delivery.

- Check for Hidden Costs: Besides the quotation, inquire about any hidden costs that may arise during the process. These could include: Maintenance charges, Utility connection fees, Clubhouse or community charges, etc. Knowing all potential costs upfront helps avoid surprises later on.

- Understand the Payment Plan: If you opt for a flexible payment plan, ensure you understand the schedule and interest rates (if applicable). Some plans offer early-payment discounts, while others may include financing options or post-possession payment schemes. Compare these options carefully.

- Inspect the Property Before Finalizing: If possible, visit the property in person before finalizing the deal. Walk through the site to check construction quality, view amenities, and gauge the surrounding area. Ensure that what’s promised in the sales brochure aligns with the actual property.

- Look for Appreciation Potential: Research how the location is expected to develop over the next few years. Check for upcoming infrastructure projects, public transport developments, or commercial centers that might increase property value. Choosing a location with growth potential can enhance your investment in the long term.

- Get Legal and Documentation Assistance: Always consult a legal advisor before signing any agreements. Ensure the builder has clear titles, the necessary approvals, and no pending disputes. Having a lawyer go through the documents will protect you from any future complications.

- Don’t Rush the Process: Don’t let the pressure from brokers or salespeople rush your decision. Take the time to evaluate all your options thoroughly. A well-thought-out investment decision will pay off in the long run.

Step 5: Final Negotiations:

After conducting your research and determining a fair value, return to the sales office with your final price expectations. Present your offer, showing you’re a serious buyer by submitting a cheque for the full token amount or the first installment, depending on the payment plan. This signals your intent to proceed, and they may be more inclined to offer a better price.

Congratulations if they agree to your price—you’ve struck a deal! However, if they don’t, the sales team will likely offer flexible payment plans to make the purchase more feasible. At this point, your broker will try to guide you through these options (e.g., 30-70, 10-90 payment plans).

If the payment plan and final price align with your budget, you can go forward and sign the deal. If not, don’t hesitate to explore other options.

More tips below-

- Act Quickly in a Fast-Paced Market: The Gurugram real estate market is known for its fast-paced nature, where properties can get snapped up quickly. If you find an opportunity that meets your criteria, don’t hesitate to make a decision to avoid missing out.

- Request Proof for Project Details: Don’t rely solely on what brokers or salespeople tell you about the property, especially when it comes to details that are not outlined in the official documents. Always ask for physical proof or documentation, such as RERA registration, project approval certificates, and other relevant paperwork, especially for under-construction projects.

- Ready-to-Move Properties for Housing: If your budget permits, ready-to-move properties are an excellent choice for housing. While they may cost a bit more upfront, they save you from the hassles and risks often associated with under-construction projects. With a ready property, you pay for exactly what you see, reducing uncertainties.

- Consider the Property’s Rental Yield (for Investment): If you plan on renting the property out, calculate the rental yield. Compare potential rental income against the property’s price to understand the return on investment. Properties in good locations with solid rental demand can provide steady cash flow over time.

- Plan Your Exit Strategy for Investment: When investing in real estate, always plan your exit strategy before making an entry. Typically, the holding period for apartments should be between 3-4 years, depending on factors like construction quality, design, area, and facing. Keep in mind that properties with outdated designs or poor construction may not see significant appreciation, and buyers may shy away from older units.

- Prioritize Location and Facing for Resale: Whether for housing or investment, location and apartment facing are key to ensuring future resale value. Choose properties in well-connected areas, with appealing views and better orientations (e.g., park-facing or east-facing), as these tend to appreciate faster and attract more buyers in the long term.

By incorporating these tips, you can approach your real estate investment with a clear strategy, minimizing risks and maximizing your returns. These practical tips will help you navigate the fast-moving real estate market while ensuring a smoother and more informed investment journey.

If you would like to add anything else or modify any of these tips, then feel free to reach here or comment below.

Sample Cost Sheet

Amazing read, looking forward for more such insightful content.